Electronic Invoicing

via PEPPOL

Be ready before 1st January 2026 with LPLG

Electronic invoicing will become mandatory starting January 2026.

From1st January 2026, all Belgian companies will be required toissue and receive their electronic invoices via Peppol.

Peppol is asecure and standardised European networkthat allows the exchange of electronic documents between businesses and administrations.

While many access points charge for each document sent or received,Odoo offers completely free and unlimited accessto Peppol.

What is PEPPOL?

PEPPOL (Pan-European Public Procurement Online) is the official European network for the exchange of electronic invoices between businesses and administrations.

Its goal: to make billing faster, more secure, and completely automated.

Thanks to PEPPOL, you can:

Send and receive legally recognised invoices in Europe

Eliminate errors and payment delays

Simplify your accounting and tax tracking

LPLG Europe

LPLG – Your partner for quick compliance

We support you from A to Z, stress-free, so that you are operational in less than 24 hours.

Our service includes:

Full connection to the PEPPOL network

Training your teams to understand Odoo and invoicing

Ongoing support and maintenance

Configuration of your billing system (Odoo, ERP, accounting, etc.)

Verification and compliance testing

For whom?

Law firm

Independents & Entrepreneurs

Start-ups

Non-profit organizations

Online trainers

Other professions

Ready in one day

Schedule an appointment today with an LPLG consultant and receive your personalized compliance plan.

FAQ

Any questions?

Peppol (Pan-European Public Procurement OnLine) is a secure network that enables the exchange of electronic documents (such as invoices) between businesses and government agencies across Europe.

It is the standard used for mandatory electronic invoicing in Belgium and in many European countries.

Belgium is progressively implementing electronic invoicing between businesses (B2B) via Peppol.

The objectives are to:

Simplify exchanges between companies,

Reduce errors and fraud,

Automate the accounting processing of invoices,

Save time and minimize administrative costs.

All companies subject to VAT will be affected.

Since 2024, invoices to public authorities must be sent via Peppol (B2G).

Starting January 1, 2026, the obligation will extend to all invoices between businesses (B2B).

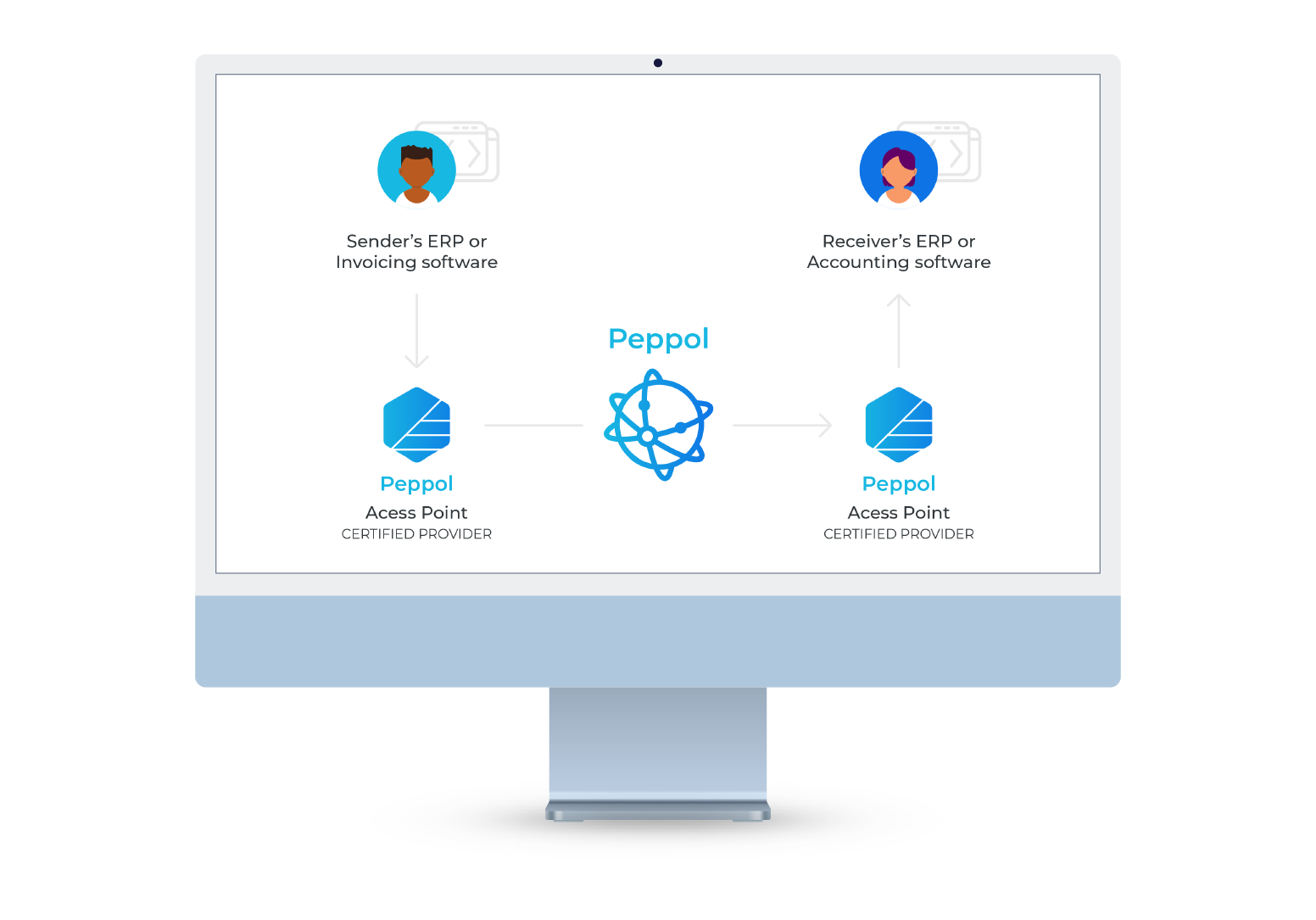

Your billing software (e.g., Odoo, Billit, Sage, etc.) sends the invoice to the Peppol network.

The network verifies the sender and recipient identifiers.

The invoice is transmitted directly and securely to the recipient’s software.

No email address or manual download is required.

The use of the billing module developed byOdoo is free. Odoo allows free and unlimited accessfor sending and receiving electronic documentsvia Peppol.

Companies use Peppol access points to exchange electronic documents, which raises the following question: what is the cost of these Peppol access points? Although rates vary from provider to provider, many adopt a credit system or charge for each document sent or received. For some companies that send thousands of documents each year, these fees can quickly add up.Odoo offers free and unlimited accessfor sending and receiving electronic documentsvia Peppol.

Our latest content

Follow our latest publications